Calculating Business Interruption Insurance Claims: Comparing Gross Receipts vs Net Income Method

In today’s dynamic business landscape, disruptions are inevitable, ranging from natural disasters to unexpected economic downturns. When such events occur, understanding the impact on business operations is crucial for swift recovery and effective insurance claims.

Numerous commercial property insurance policies mandate a Sworn Statement in a Proof of Loss for claim benefits. This document details information about the incident, like the cause and extent of damage, and financial impact to the business. Policyholders must accurately calculate business income losses covered under the policy for Proof of Loss. The policy language will dictate the approach, but industry experts generally use two common methods for calculating business income losses.

The Bottom-Up or Net Income Method

The bottom-up method, also known as the net income method, provides a thorough way to estimate business interruption insurance claims. It involves carefully analyzing a company’s financial records and examining revenue streams and expenses to calculate the net income lost during the interruption period. Unlike other methods, the bottom-up approach considers specific factors like variable costs, seasonal fluctuations, and potential growth trajectories, rather than relying on just broad assumptions or industry averages.

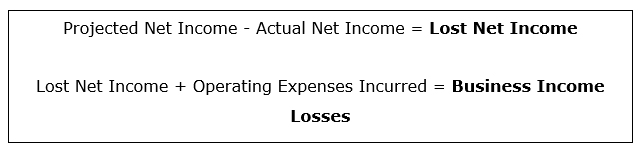

Under this method, the policyholder must determine two main factors. First, they must determine the net income that should have been earned during the period of loss. Second, add the actual operating expenses that continued during that loss period. The formula looks as follows:

Let’s clarify exactly what is factored into projected net income, actual net income, and operating expenses incurred:

Projected Net Income is the revenue the policyholder would have earned during the Period of Restoration that occurs within the 12 months after the date of direct damage or loss. This amount will cover costs that would have been expended to generate that revenue and sustain normal operations, including all direct, indirect, variable, and fixed expenses.

Actual Net Income refers to the revenue realized by the policyholder during the Period of Restoration minus all costs directly associated with revenue generation and sustaining regular operations. This calculation incorporates all types of expenses, whether direct, indirect, variable, or fixed, providing a comprehensive assessment of the net income generated during the restoration period.

Operating Expenses Incurred refer to what the company incurred during the Period of Restoration and ramp-up period. Operating expenses are costs a business incurs through its normal business operations, beyond direct materials and labor.

The Top-Down or Gross Receipts Method

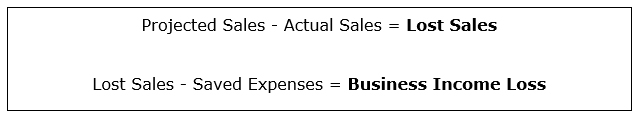

The top-down or gross receipts method offers a simplified yet effective approach to estimating business interruption insurance claims. Unlike the detailed analysis of the bottom-up method, this approach focuses on a broader view of the business’s revenue streams during the interruption period. Like the bottom-up, this method also requires the policyholder to determine two main factors. First, they must calculate the lost sales resulting from business suspension. Second, subtract expenses that were saved as a result of not achieving those projected sales. The formula looks as follows:

Let’s break down projected sales, actual sales, and saved expenses even further:

Projected Sales are the revenue that would have been earned between the data of the property damage that occurred and suspended operations to the date when it resumed or could have possibly resumed normal operations. To develop project sales, the policyholder can consider factors such as:

- The history of sales in the years before

- The pre-loss monthly sales average

- Actual purchase orders or contracts that could not be fulfilled due to the event that halted normal business operations

- The rate of inflation

- Other factors that could influence any expected sales volume or prices

Actual Sales are the revenue realized by the business during the Period of Restoration. Now actual sales will depend on the impact of the incident and there is commonly little to no Actual Sales during this period.

Saved Expenses are determined after Lost Sales and this number should include both variable direct costs and variable indirect costs that a business would have incurred as a result of not making sales.

- Variable direct costs, like raw materials and direct labor, fluctuate with production levels. They directly contribute to producing goods or services and increase or decrease in line with changes in output.

- Variable indirect costs, such as utilities and maintenance, also fluctuate with production levels but are not directly linked to individual units produced. They support production activities broadly and vary with changes in operational volume.

Understanding What Works for You

Whether you decide to utilize the top-down or bottom-up method for estimating business interruption insurance claims, the key lies in a thorough understanding of your business’s operations, risks, and finances. While the top-down approach offers a broad perspective and simplifies complex calculations, the bottom-up method provides granular detail and accuracy.

Whichever method you choose, it’s essential to consider the unique circumstances of your business to ensure comprehensive coverage and swift recovery in the event of unforeseen disruptions. By adopting a strategic approach to estimating business interruption insurance claims, businesses can safeguard their financial stability and resilience.