The Truth About Workers’ Compensation and Taxes

Workers’ compensation provides financial support to employees who are injured or become ill because of their job. This support includes wage replacement and medical benefits, ensuring that employees can focus on their recovery while being covered for:

- Accidents, injuries, or illnesses resulting from work

- Lost wages due to work-related injuries or illness

- Medical care including but not limited to: Hospitalization, Doctor appointments, Prescriptions

- Any other ongoing care such as long-term medical care or physical therapy

- Funeral costs, in cases where accidents cause death

Workers’ compensation is required for businesses and offers three primary forms of business protection: medical expenses and lost wages, death and survivor benefits, and employer liability. If businesses do not provide workers’ comp, there can be fines or felony charges for businesses.

For employees, it is important to note that several circumstances are not covered under workers’ compensation including commuting to and from work, injuries when participating in voluntary social work events, being injured while intoxicated at work, or being injured in workplace fights unless you were an innocent bystander.

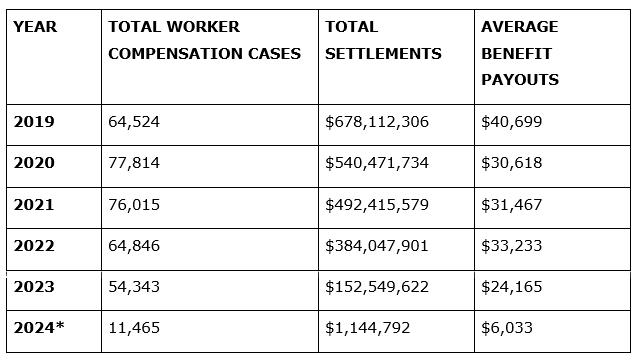

The Average Workers’ Comp Payout Chart

Workers’ comp cases are very common and incredibly beneficial in supplementing income for the injured party and their families. Let’s look at the total number of cases, total settlements, and average benefit payout in workers’ compensation cases over the last five years.

This data gathered from the WC Claims Database provided by Florida’s Division of Workers’ Compensation can be accessed at any time and provide valuable insight into workers’ compensation.

*2024’s data is current up to May 2024; these numbers will change as they update the database throughout the year.

But is the Payout Taxable?

Employees have a legal right to these payouts, and they are often referred to as a type of income, which leads to the question, is this taxable? Great news, workers’ compensation payouts are not considered taxable because they are considered a form of insurance, not income. This means that the money you receive for lost wages or medical expenses because of a work-related injury or illness is not subject to federal or state income taxes.

The Exceptions to the Rule

There are possible exceptions and that can be if you are receiving either Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) on top of your benefits then you may be required to pay taxes. What exactly are SSI and SSDI?

Supplemental Security Income (SSI)

SSI is a welfare program that provides cash and health care on a monthly basis to individuals who meet the following guidelines:

- Over the age of 65

- Blind or disabled

- A United States citizen

- On a limited income

Social Security Disability Insurance (SSDI)

SSDI is a federal insurance program that is tax-funded. Workers receive monthly benefits when they meet the following guidelines:

- Have a disability

- Paid SS payroll taxes for a certain amount of time

- On a limited income

SSI and SSDI qualify as exceptions because the Social Security Administration (SSA) implements a practice known as workers’ compensation offset where they are required to ensure that the total amount of benefits between your disability payments and workers’ comp benefits does not exceed the applicable threshold.

Another exception would be if you are working on light or limited duty while still under the care of the authorized doctor, you will need to pay taxes on any wages earned while you worked. If you do return to work, then you may be entitled to temporary partial disability benefits, but this is only if you are unable to earn at least 80% of your previous wages due to work restrictions.

Have Questions About Workers’ Compensation?

Need help navigating the process? Contact The Law Offices of Bram J. Gechtman today for expert guidance and support. Our team of experienced professionals is here to assist you every step of the way, ensuring you receive the compensation and benefits you deserve. Whether you’re dealing with a work-related injury, disability, or any other workers’ comp issue, we’re here to help. Contact us today for a free consultation at (305) 222-7836.